Five of the Biggest Market Challenges for Fintech’s and where IgniteFI can help you overcome these challenges.

Three Step Framework Your Own Trail in Credit Unions

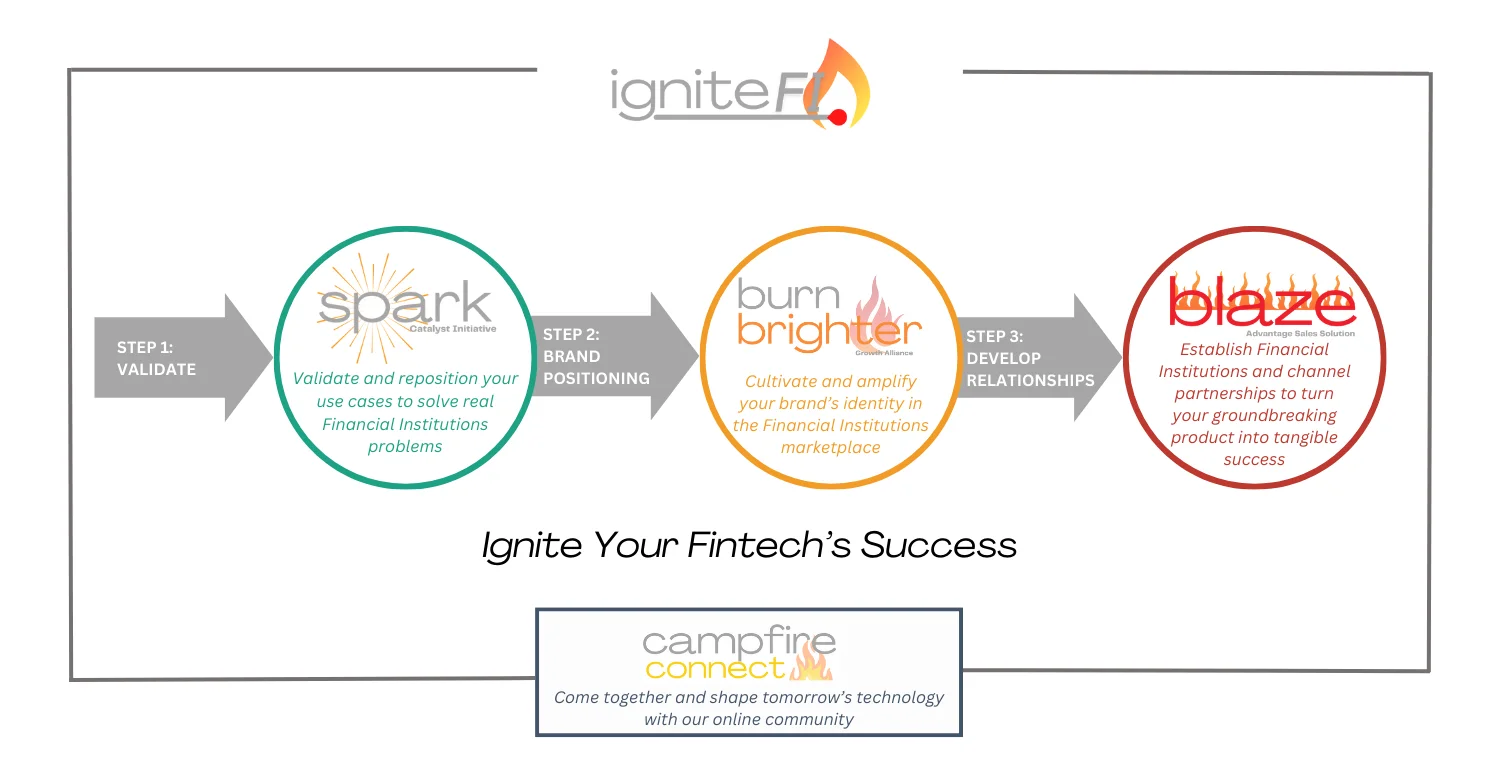

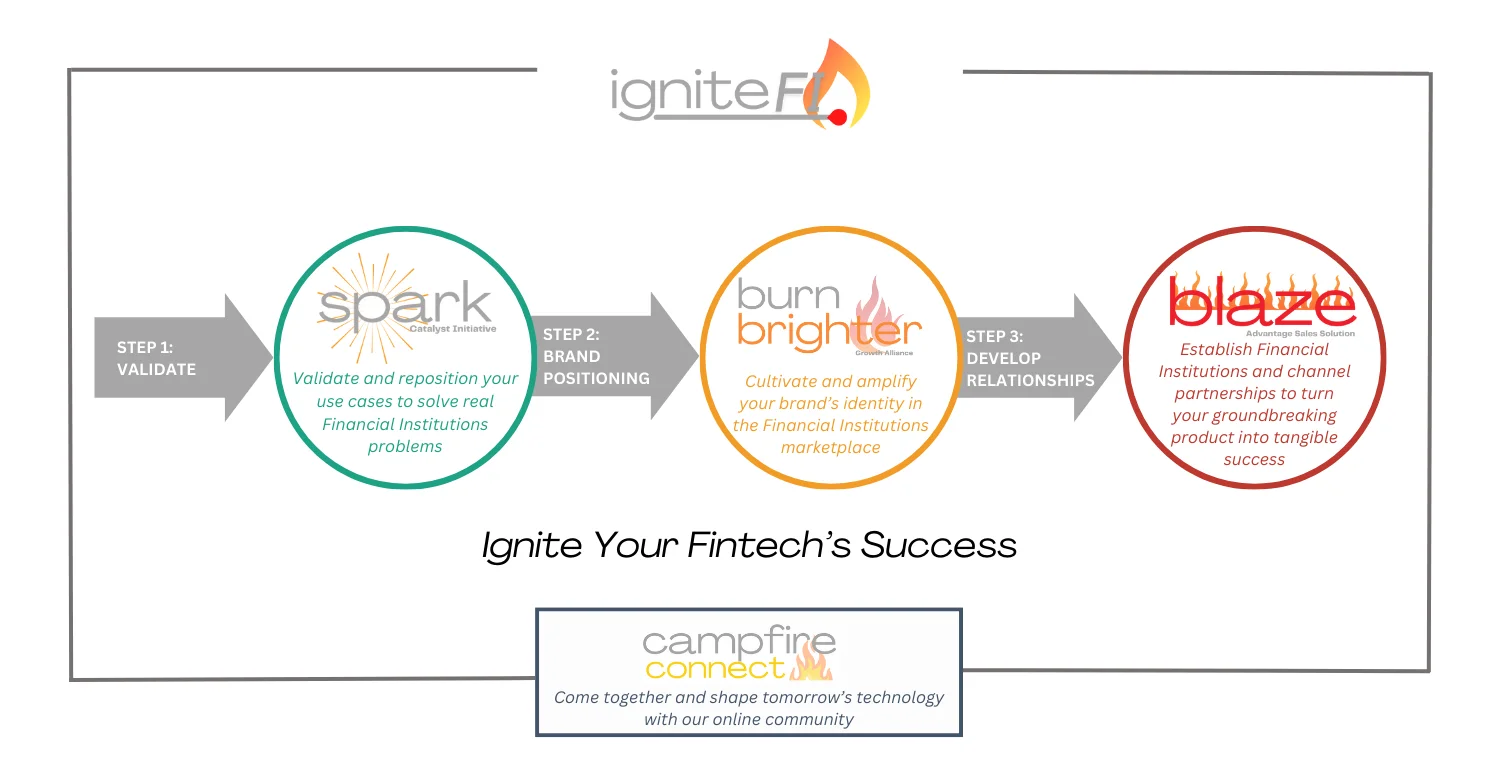

In the dynamic world of Fintech, standing out and ensuring your product reaches its target audience is vital. This process involves a comprehensive understanding of your brand’s identity, a robust presentation of your offerings, and the essential skills to effectively communicate and deliver to potential clients. To guide you through this journey, we’ve outlined a three-step framework:

IgniteFI Events for 2026

Firecracker Virtual Fintech Showcase – Wed, Feb 11th, 12:00 PM – 1:30 PM (EST)

Registration Coming Soon!

IgniteFI Blogs

Credit Unions: Purpose, Structure, and Fintech Opportunities

For fintech leaders, credit unions represent an often-overlooked but high-potential sector for innovation and ...

5 Key Learnings From 2024 Credit Union Trends

In 2024, credit union trends faced rapid changes in digital innovation, data privacy, and ...

Why Credit Unions Should Partner with Fintechs

In today’s rapidly evolving financial landscape, credit unions fintech partnerships are becoming essential for staying ...

Navigating Credit Union Compliance for Fintech Leaders

The fintech industry is reshaping financial services, and credit unions present exciting opportunities for ...

“IgniteFI has been a key business contact for me. The team always represented the organizations they work for with professionalism, dedication and hard work. They know how to navigate and complete difficult projects that require lots of coordination across 3rd parties. The team is great to work with and highly respected in the industry.”

“I highly recommend IgniteFI after having the opportunity to work with the team in a number of instances. They bring a unique blend of marketing and branding prowess with a level of thoroughness and attention to detail that is always needed, regardless of the size of an organization. The team has a strong work ethic and engaging personalities that brings a team up and keeps them motivated.”

“I was first introduced to IgniteFI when Bonifii (orginally CULedger) was just getting started. The team singlehandedly tackled the job of educating the CU industry about SSI and verifiable credentials. I watched IgniteFI pull off multiple marketing campaigns introducing a new technology to a skeptical industry. This team knows their audience and knows how to message them—a real marketing communications pro.”

“The team at IgniteFI has a wealth of knowledge in fintech and financial services. They have been working with credit union leaders for many years. They have a unique ability to explain technology and show executives how they can leverage it.

They have the experience, wisdom, and communication skills to assist any organization grow their business and adapt to the constantly changing business landscape.”

“We’ve had the opportunity to partner with Julie for about a year now. We brought her in to fill a gap we had in our marketing and partnership area. She has been a joy to work with, and she’s earned my highest praise and recognition.

“We’ve specifically leveraged Julie’s marketing expertise and knowledge of the credit union industry. She’ll continue to be a strong resource for us as we continue to expand into the credit union space.

“Plus, in addition to the marketing support she provides, Julie’s extensive connections across the credit union market have generated productive partnership development results for us.

“The RiskScout marketing and partnership function is in a much better spot compared to when Julie arrived. I hope we continue to work together for a long time.”

“I began collaborating with Julie during our early days as CULedger. She was instrumental in getting CULedger off the ground. Julie took charge of our CUSO structure development, go-to-market strategy, masterminded our corporate and product branding, and was pivotal in the successful launch and widespread adoption of MemberPass. Now, as we operate as Bonifii, Julie continues to be an invaluable asset in her fractional CMO role. With her and her team’s expertise, they’ve significantly shaped who we are today!”

FIVE OF THE BIGGEST MARKET CHALLENGES FOR FINTECHS

Credibility

Credibility is the #1 challenge for every Fintech. The financial industry must trust you. They have to believe you can help them improve their service, upgrade user experiences, simplify a process, or streamline internal activities.

Discovery

It’s also tricky to find reliable ways for prospects to discover your products or services. This is where we come in. We have deep and wide financial industry knowledge. We know how to get the attention of industry influencers early in the discovery process. This can be a big advantage for any Fintech.

Customer Growth & Loyalty

All Fintech growth requires new customers. Therefore, your number one priority is to implement productive ways to generate solid leads. We can help with this. We can also show you ways to build successful long-term relationships and develop a loyal customer base.

Lack of Resources

Many Fintechs lack the money and time necessary to manage internal marketing and sales teams. We can provide great value here. Offload these responsibilities to IgniteFI and watch your growth take off.

Strategy

Financial institutions today have evolving strategic needs, and while fintechs offer specialized solutions, they often lack go-to-market expertise. With over 25 years of industry experience and relationships with 300+ partners, we bridge this gap, optimizing contracts and revenue models for success.

Three Steps to Blazing Your Own Trail in Financial Institutions

In the dynamic world of Fintech, standing out and ensuring your product reaches its target audience is vital. This process involves a comprehensive understanding of your brand’s identity, a robust presentation of your offerings, and the essential skills to effectively communicate and deliver to potential clients. To guide you through this journey, we’ve outlined a three-step framework:

Credit Unions: Purpose, Structure, and Fintech Opportunities

For fintech leaders, credit unions represent an often-overlooked but high-potential sector for innovation and ...

5 Key Learnings From 2024 Credit Union Trends

In 2024, credit union trends faced rapid changes in digital innovation, data privacy, and ...

Why Credit Unions Should Partner with Fintechs

In today’s rapidly evolving financial landscape, credit unions fintech partnerships are becoming essential for staying ...

Navigating Credit Union Compliance for Fintech Leaders

The fintech industry is reshaping financial services, and credit unions present exciting opportunities for ...

“IgniteFI has been a key business contact for me. The team always represented the organizations they work for with professionalism, dedication and hard work. They know how to navigate and complete difficult projects that require lots of coordination across 3rd parties. The team is great to work with and highly respected in the industry.”

“I highly recommend IgniteFI after having the opportunity to work with the team in a number of instances. They bring a unique blend of marketing and branding prowess with a level of thoroughness and attention to detail that is always needed, regardless of the size of an organization. The team has a strong work ethic and engaging personalities that brings a team up and keeps them motivated.”

“I was first introduced to IgniteFI when Bonifii (orginally CULedger) was just getting started. The team singlehandedly tackled the job of educating the CU industry about SSI and verifiable credentials. I watched IgniteFI pull off multiple marketing campaigns introducing a new technology to a skeptical industry. This team knows their audience and knows how to message them—a real marketing communications pro.”

“The team at IgniteFI has a wealth of knowledge in fintech and financial services. They have been working with credit union leaders for many years. They have a unique ability to explain technology and show executives how they can leverage it.

They have the experience, wisdom, and communication skills to assist any organization grow their business and adapt to the constantly changing business landscape.”

“We’ve had the opportunity to partner with Julie for about a year now. We brought her in to fill a gap we had in our marketing and partnership area. She has been a joy to work with, and she’s earned my highest praise and recognition.

“We’ve specifically leveraged Julie’s marketing expertise and knowledge of the credit union industry. She’ll continue to be a strong resource for us as we continue to expand into the credit union space.

“Plus, in addition to the marketing support she provides, Julie’s extensive connections across the credit union market have generated productive partnership development results for us.

“The RiskScout marketing and partnership function is in a much better spot compared to when Julie arrived. I hope we continue to work together for a long time.”

“I began collaborating with Julie during our early days as CULedger. She was instrumental in getting CULedger off the ground. Julie took charge of our CUSO structure development, go-to-market strategy, masterminded our corporate and product branding, and was pivotal in the successful launch and widespread adoption of MemberPass. Now, as we operate as Bonifii, Julie continues to be an invaluable asset in her fractional CMO role. With her and her team’s expertise, they’ve significantly shaped who we are today!”